[2002] ATP 15

Catchwords:

Managed investment schemes – merger proposal – use of trust scheme to effect merger – acquisition and transfer effected by change in constitution – comparison of trust schemes to schemes of arrangement – compulsory acquisition – insufficient disclosure in explanatory statement – voting rights of related entities – competing scrip and cash bid – power to modify Corporations Act section 611 item 7 to allow trust merger scheme – review of ASIC decision

Corporations Act 2001 (Cth), sections 606, 611 item 7, 601GC, 604(1) and 655A Corporate Law Economic Reform Program Act 1999 (Cth)

ASIC Policy Statement 74

Cachia v Westpac Financial Services Ltd (2000) 18 ACLC 293

Re The Bank of Adelaide Ltd (1979) 22 SASR 481

Re Archaean Gold NL (1997) 23 ACSR 143

Nicron Resources Ltd v Catto (1992) 8 ACSR 219

Catto v Ampol Ltd (1989) 15 ACLR 307

These are our reasons for declining to make a declaration of unacceptable circumstances in response to the application by Mirvac Funds in relation to the proposed merger between Colonial First State Property Trust Group and Commonwealth Property Office Fund and Gandel Retail Trust. We also set out our reasons for declining the application by Mirvac to vary or revoke the modification of Item 7 of section 611 of the Corporations Act. The Panel considered that the undertakings offered in relation to disclosure and voting issues adequately addressed its concerns in relation to the Merger Proposal and the modification.

- These reasons relate to two applications. The first was the application (657 Application) on 30 August 2002 by Mirvac Funds Limited (Mirvac) for a declaration of unacceptable circumstances pursuant to section 657A of the Corporations Act 2001 (Act). The application was in respect of a proposal (Merger Proposal) announced by the responsible entities for Commonwealth Property Office Fund (Commonwealth Fund) and Gandel Retail Trust (Gandel Fund) for Commonwealth and Gandel to merge the four funds which make up the Colonial First State Property Trust Group (Colonial Funds) with the Commonwealth and Gandel Funds.

- The second was the application (656 Application) dated 2 September 2002 by Mirvac and Mr. Roger Fortune for a review of a decision of the Australian Securities and Investments Commission (ASIC) pursuant to section 656A of the Act modifying item 7 of section 611 of the Act (Item 7).

- The sitting Panel (the Panel) for both Applications was Professor Ian Ramsay (sitting President), Ms Karen Wood (sitting Deputy President) and Ms Jennifer Seabrook.

- The Panel decided, under Regulation 20 of the ASIC Regulations, to conduct proceedings in relation to both Applications.

- The Panel advised the parties of its final decision in this matter on 11 September, once it had received the undertakings set out below from parties.

Summary

- The Merger Proposal announced on 27 July 2002 was a "Transfer Merger", whereby the Responsible Entities of the Commonwealth Fund (Commonwealth Responsible Entity) and the Gandel Fund (Gandel Responsible Entity) would offer Commonwealth and Gandel Fund units in exchange for acquiring all of the units in the Colonial Funds. Unitholders in the Colonial, Commonwealth and Gandel Funds initially would vote on the Merger Proposal at meetings (Meetings) to be held on 3 September, 5 days after the date of the application.

- On 27 August, Mirvac announced that it proposed to make a rival offer to the unitholders in the Colonial Funds by way of a Chapter 6 takeover bid, offering Mirvac stapled securities as part of its consideration.

ASIC Modification

- Without a modification from ASIC, the Merger Proposal could not proceed because the Corporate Law Economic Reform Program Act of 1999 (CLERP Act) had brought the acquisition of units in listed Managed Investment Schemes under Chapters 6 to 6C of the Act, and therefore section 606 (the 20% threshold) would prohibit the Commonwealth Responsible Entity1 from acquiring all of the units in the Colonial Funds. None of the standard exceptions in section 611 applied, and Item 7, the most likely one, was not available because all Colonial Funds unitholders would dispose of their Colonial Funds units under the Merger Proposal, so none of them could vote and the resolutions could not be passed.

- On 29 July 2002, ASIC granted a modification of Item 7 which allowed the Merger Proposal to be able to be put to Colonial Funds unitholders.

Mechanism

- While the Item 7 resolutions would allow the Merger Proposal to proceed through the 20% threshold in section 606, the actual acquisition and transfer of Colonial Funds units from the Colonial Funds unitholders to the Commonwealth Responsible Entity would be effected by a change in the Colonial Funds' constitutions under section 601GC of the Act.

- Mirvac complained that the Merger Proposal allowed the Commonwealth Responsible Entity to compulsorily acquire the units of any Colonial Funds unitholder who either did not vote on, or voted against, the Merger Proposal. Mirvac argued that either compulsory acquisition of units in Listed Managed Investment Schemes should only proceed under the procedures of Chapter 6A of the Act, or if under another mechanism, only if the thresholds for approval of compulsory acquisition under Chapter 6A had been met.

- The Panel did not accept the proposition put forward by Mirvac. It accepted that the Act provides more than one way for mergers of Listed Managed Investment Schemes to proceed, and the Act sets no preference for mergers proceeding via any particular method, so long as the method is legally competent, and does not lead to unacceptable circumstances. This is consistent with the views expressed by courts for a long period in relation to company takeovers effected by way of Schemes of Arrangement under Part 5.1 of the Act.

- Accordingly, the Panel declined to declare that the Merger Proposal mechanism, per se, constituted unacceptable circumstances.

Disclosure

- However, the Panel considered that the Merger Proposal as formulated had deficiencies in relation to various disclosure issues in the Explanatory Statement which the Colonial Responsible Entity sent with the notice of meeting (Explanatory Statement). Those deficiencies were resolved by undertakings from a number of parties.

Voting

- Unitholders in each of the four Colonial Funds would vote on two resolutions. The first would be a resolution under Item 7, permitting the acquisition of Colonial Funds units by Commonwealth and Gandel under the Merger Proposal. The second would be under section 601GC, changing the constitution of the Colonial Funds and, as explained above, effectively carrying out the Merger Proposal.

- A key issue in the Panel's consideration was whether a particular group of unitholders in the Colonial Funds (the Associated Unitholders) should vote at the Meetings. Those unitholders are fund managers for various Managed Investment Schemes or life insurance funds and are also related entities of the Colonial Responsible Entity's parent company the Commonwealth Bank of Australia (CBA). The Panel considered that the related nature of the various fund management entities generates the potential for conflict of interest.

- The Panel accepted undertakings from the Associated Unitholders affirming their obligations to act in the best interests of the persons on whose behalf they hold or control the units.

Future

- The Panel notes that the issues raised in this application go to some fundamental policy questions in relation to Managed Investment Schemes. The Panel proposes to forward these issues to a working group to consider public consultation before finalising the appropriate policy in this area. The Panel has invited ASIC to make the working group a joint project. ASIC has agreed to participate in an initial scoping meeting to discuss the terms of reference of the proposed working group and to enable it to consider whether it is appropriate for ASIC to participate in such a group. The public policy process, combined with the special facts of this matter, will very likely limit the value of this decision as precedent.

Background

- The following is a description of the facts underlying the Applications, which has largely been taken from the Applications.

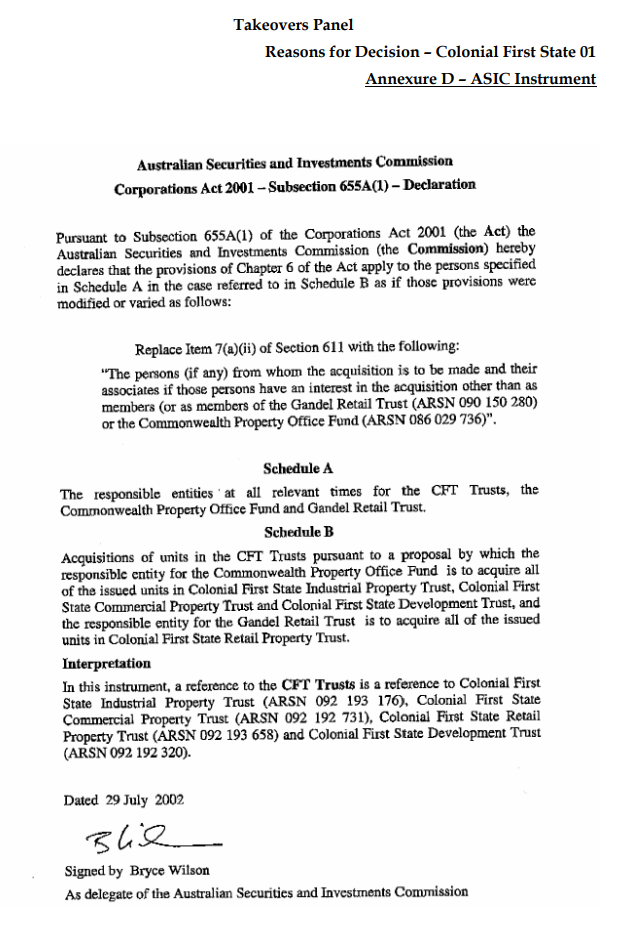

- On 29 July 2002, ASIC made a declaration under section 655A of the Act in relation to the Merger Proposal which modified the provisions of Item 7. It primarily removed a prohibition on voting on the Item 7 resolution from any Colonial unitholder whose interest in the resolutions was merely as a unitholder in the Colonial, Commonwealth or Gandel Funds. The modification replaces item 7(a)(ii) of section 611 of the Act with the following:

"The persons (if any) from whom the acquisition is to be made and their associates if those persons have an interest in the acquisition other than as members (or as members of the Gandel Retail Trust (ARSN 090 150 280) or the Commonwealth Property Office Fund (ARSN 086 029 736)".

- On 30 July 2002 the Colonial Responsible Entity lodged an announcement on ASX advising of the Merger Proposal. The announcement:

- referred to the proposed unitholders meetings to be held on 3 September 2002 at which unitholder approval to resolutions pursuant to section 611 (item 7) would be sought, such approvals being, conditions of the Merger Proposal;

- referred to an independent expert's report which contained the opinion that the proposal "is fair and reasonable and in the best interests of unitholders";

- On 30 July 2002 the Commonwealth Responsible Entity, one of the proposed acquirers of Colonial Funds units under the Merger Proposal, lodged an announcement on ASX also advising of the Merger Proposal. The announcement was in similar terms to that by the Colonial Responsible Entity.

- On or about 7 August 2002 the Colonial Responsible Entity distributed a Notice of Meeting and Explanatory Memorandum relating to the Merger Proposal to unitholders in the Colonial Funds. In it, the directors of the Colonial Responsible Entity (Colonial Directors) advised (without caveat) that they "unanimously agree that the Proposal is fair and reasonable and in the best interest of CFT unit-holders".

- The explanatory memorandum describes the relationship between a number of entities which are involved in the Merger Proposal and which appear to be associates of the Commonwealth Bank of Australia.

- After 4.00 p.m. (EST) on 27 August 2002 Mirvac lodged with ASX an announcement of its intention to make an off-market bid to acquire all the units in the Colonial Funds.

- As at the close of trading on ASX on 27 August 2002:

- Mirvac Funds units had a closing market price of $4.11;

- Colonial Funds units had a closing market price of $2.17;

- Gandel Funds units had a closing market price of $1.25;

- Commonwealth Funds units had a closing market price of $1.16.

- On 28 August 2002 at approximately 10.13 a.m. a trading halt in relation to units in the Colonial, Gandel and Commonwealth Funds took effect on ASX. The trading halt was lifted at the opening of trading the next day, 29 August, after the Colonial Responsible Entity made the announcement referred to below.

- On 29 August 2002 the Colonial Responsible Entity lodged an announcement with ASX advising of:

- an increased consideration offered under the Merger Proposal by Gandel and Commonwealth;

- the Mirvac offer; and

- the postponement of the Meetings until 10 September.

Applications

- In the 657 Application, Mirvac applied for a declaration of unacceptable circumstances in relation to the affairs of the Colonial Funds. It asserted that unacceptable circumstances occurred as a result of the Merger Proposal and the proposed acquisition by Commonwealth and Gandel of all the Colonial Funds units under the resolution (or any amended resolutions) to be considered at the Meetings.

- In the 656A Application, Mirvac sought a review of ASIC's decision and for the Panel to reverse ASIC's decision or remit the matter to ASIC and direct ASIC to remake the decision with any directions or recommendations that the Panel, in the circumstances, considered appropriate.

- The Panel considered that the two applications raised essentially identical issues and would be decided on essentially the same policy and other considerations. Therefore it decided to run the two applications concurrently and included its requests for submissions in the same brief.

Orders sought

Interim Orders

- If the Panel did not decide the Application on or before 9 September 2002, Mirvac sought interim orders pursuant to section 657E(1) of the Act that:

- the Colonial Responsible Entity make an immediate announcement to all relevant stock exchanges to the effect that, until this Application has been finally determined, the meetings of unitholders of Colonial Funds which had been convened to be held on 10 September 2002 (Meetings)2 would be adjourned; and

- the Colonial Responsible Entity be restrained from conducting the Meetings on 10 September 2002, except for the purpose of adjourning the Meetings until such date as considered appropriate by the Panel; or

- such interim orders as the Panel considers appropriate in the circumstances.

Final orders

- Mirvac sought final orders, following the making of the Declaration referred to above, that:

- the Commonwealth and Gandel Funds (and the Responsible Entities therefor) should be restrained permanently from acquiring the Colonial Funds units pursuant to the resolutions proposed to be considered at the Meetings.

- The Meetings be cancelled.

- Alternatively to orders (1) and (2) that a procedure which is acceptable to the Panel be implemented by the Commonwealth and Gandel Funds (and their respective Responsible Entities) to ensure that:

- the holders of Colonial Funds units are provided with such information as may be required by Chapter 6 of the Corporations Act about the Merger Proposal as if the Merger Proposal proceeded by way of off-market bid and they have a reasonable time to consider that information; and

- appropriate safeguards are implemented to ensure that Colonial Funds units are not able to be compulsorily acquired unless the resolutions are approved by 75% in number of the holders as at the date the resolutions are passed who hold in the aggregate not less than 90% of the units in issue as at that date and that in the event these requirements are satisfied that appropriate safeguards are implemented to ensure that holders of Colonial Funds units who either did not vote on the resolutions, or voted against the resolutions, which are subject to compulsory acquisition have available to them protections akin to those afforded by Part 6A.1 of Chapter 6A.

- Such further or other orders as the Panel considers appropriate.

The Merger Proposal

- The Merger Proposal involves the acquisition by the Commonwealth and Gandel Responsible Entities of all the units in the Colonial Funds with the approval of unitholders of the various trusts under Item 7 and an amendment of the relevant trust constitutions under section 601GC of the Act. The Merger Proposal was to be subject to approval by unitholders in the Commonwealth and Gandel Funds on the same day.

- The Commonwealth Responsible Entity would acquire all of the units in the Colonial Funds trusts that hold office and industrial property. The Gandel Responsible Entity would acquire all of the units in the Colonial Funds trust that holds retail property assets. Colonial Funds unitholders would be issued with units in both the Commonwealth and Gandel Funds.

- The Merger Proposal also features a cash alternative, via a sale of Commonwealth and Gandel Fund units through a bookbuild process. It allows Colonial unitholders to receive cash instead of Commonwealth and Gandel Funds units, if they so elect. Foreign resident unitholders will receive cash, via the bookbuild process, for their Colonial Funds units.

- On 29 August, Colonial announced enhancements to the Merger Proposal (Enhancements). This announcement was in response to the announcement of Mirvac's rival bid (see below). The Enhancements were:

- further consideration of 15.5 cents per Colonial Funds unit, funded by Commonwealth Bank of Australia and the Gandel Group;

- a reduction in the management fees payable to the Gandel Responsible Entity;

- the distribution to Gandel Fund unitholders of an additional amount equal to 7% of the distributed earnings of Gandel Retail Management; and

- the Commonwealth Responsible Entity extending its fee waiver by $2.5 million for the year ending June 2004.

Mirvac's rival bid

- On 27 August 2002 Mirvac announced its intention to make a takeover bid for the Colonial Funds, offering stapled securities (shares and units) (Mirvac Bid). The Mirvac Bid is to be by way of a scrip for scrip exchange (with a bookbuild cash alternative). In its announcement, Mirvac stated that the implied value of its offer was $2.35 per unit in the Colonial Funds, based on ASX closing prices on 26 August 2002. The corresponding value of the Merger Proposal (without the Enhancements) was said to be $2.19 per unit in the Colonial Funds.

- At the time of the Applications, Mirvac had not yet lodged a Bidder's Statement.

- On 4 September, subsequent to the announcement of the Enhancements, Mirvac announced an increased offer, consisting of:

- 20 cents cash per Colonial unit plus one Mirvac security for each 1.89 Colonial Funds units or one Mirvac security for each 1.73 Colonial Funds units;

- one Mirvac option (with a strike price of $4.50 exercisable in two years) for every 14 Colonial Funds units; and

- a capital distribution of 0.8 cents per Colonial Funds unit.

- According to Mirvac's announcement, Mirvac's revised bid was valued at $2.41 per Colonial Funds unit, based on Mirvac Fund's volume weighted average price on September 3 of $4.15.

Legislation

- Prior to March 2000, the takeovers provisions of the Corporations Act and its predecessors did not regulate the acquisition of interests in Listed Managed Investment Schemes. However, the CLERP Act expanded the scope of the takeovers regime to include Listed Managed Investment Schemes. Prior to that, takeovers type issues for Listed Managed Investment Schemes had been regulated by provisions in trust deeds and stock exchange listing rules. A large part of the arguments in these proceedings relates to the extent, if any, that the CLERP Act requires takeovers or mergers of Listed Managed Investment Schemes to proceed under Chapter 6, displacing other mechanisms.

Item 7

- Item 7 started as section 12(g) of the Companies (Acquisition of Shares) Act 1980. It progressed to section 623 of the Corporations Law in 1991, and to Item 7 in 2000. Its primary purpose, as drafted, is clear. It is designed to allow the disinterested shareholders of a company to approve an acquisition of shares which would otherwise be prohibited by section 606 (or its predecessors). It has been common to Item 7 and all its predecessors that any person who would acquire, or dispose of, the securities to which the resolution related may not vote on the resolution.

- As it is drafted, Item 7 could not be used to approve the Merger Proposal. As all Colonial unitholders would transfer their units to the Commonwealth and Gandel Responsible Entities all of the Colonial Funds unitholders would be prevented from voting, under Item 7.

- The Merger Proposal is one of a type of actions that has previously been referred to as "Trust Schemes", and the analogy frequently has been drawn between such Trust Schemes and Schemes of Arrangement carried out under Part 5.1 of the Act. While expressing no view as to the validity of Trust Schemes prior to the CLERP Act, Mirvac asserted that the introduction of the CLERP Act, bringing Listed Managed Investment Schemes under the takeovers provisions, made Trust Schemes no longer valid.

- Item 7 sets out the exemption from the prohibition in section 606, for certain acquisitions by shareholders, as follows:

An acquisition approved previously by a resolution passed at a general meeting of the company in which the acquisition is made, if:

- no votes are cast in favour of the resolution by:

- the person proposing to make the acquisition and their associates; or

- the persons (if any) from whom the acquisition is to be made and their associates; and

- the members of the company were given all information known to the person proposing to make the acquisition or their associates, or known to the company, that was material to the decision on how to vote on the resolution, including:

- the identity of the person proposing to make the acquisition and their associates; and

- the maximum extent of the increase in that person's voting power in the company that would result from the acquisition; and

- the voting power that person would have as a result of the acquisition; and

- the maximum extent of the increase in the voting power of each of that person's associates that would result from the acquisition; and

- the voting power that each of that person's associates would have as a result of the acquisition.

- no votes are cast in favour of the resolution by:

Section 601GC

- Section 601GC "Changing the constitution " provides:

- The constitution of a registered scheme may be modified, or repealed and replaced with a new constitution:

- by special resolution of the members of the scheme; or

- by the responsible entity if the responsible entity reasonably considers the change will not adversely affect members' rights.

- The responsible entity must lodge with ASIC a copy of the modification or the new constitution. The modification, or repeal and replacement, cannot take effect until the copy has been lodged. (3) The responsible entity must lodge with ASIC a consolidated copy of the scheme's constitution if ASIC directs it to do so. (4) The responsible entity must send a copy of the scheme's constitution to a member of the scheme within 7 days if the member:

- asks the responsible entity, in writing, for the copy; and

- pays any fee (up to the prescribed amount) required by the responsible entity.

- The constitution of a registered scheme may be modified, or repealed and replaced with a new constitution:

- The provision was introduced as part of the Managed Investment Act in 1998. It allows for the constitution of a registered scheme to be amended by special resolution of the unitholders. On its face, the amending power appears to be unconfined, although its exercise is subject to the equitable doctrine of fraud on a power3 .

- The secondary material in relation to section 601GC is silent on whether it can be used to effect compulsory acquisition under a Trust Scheme. At the time that the section was included in the legislation, constitutional amendments had been used to effect mergers of unit trusts. The Managed Investments Act 1998 did not explicitly rescind or confine that practice.

ASIC Policy

- ASIC's Policy Statement 74 is relevant to this matter (although it was drafted by the ASC before the introduction of the CLERP Act and adopted by ASIC pro tem, and so does not directly address the issue of acquisitions of units in Managed Investment Scheme at all). In the Policy Statement, ASIC addresses issues of disclosure, the use of "fair and reasonable", information to shareholders and other issues. At paragraphs 51 to 53, ASIC addresses the argument that the wording of Item 7 would, in cases similar to the Merger Proposal, prevent all unitholders from voting. ASIC states that it will consider applications to modify the provisions to remove uncertainty arising in such circumstances as under the Merger Proposal, but it does not address the issues in any detail.

- On that basis the Panel does not think that there is any clear statement of ASIC policy to apply or assist the Panel.

- The relevant paragraphs are:

[PS 74.51] Section 623 only applies if the allottee or purchaser and vendor of the shares and any of their associates do not vote on the resolution which relates to the allotment or purchase. The essence of agreement under s623 is that it is given only by those shareholders who will not gain from the transaction (other than as ordinary members of the company) and who are not acting in concert with those who will.

[PS 74.52] If shareholder agreement is sought under s 623 for the sale by all shareholders of all or some stated proportion of their shareholding to a named person, there is an argument that all of the shareholders are precluded from voting at the meeting.

[PS 74.53] The ASC will consider applications to modify s 623 to remove any uncertainty arising in these circumstances.

Section 656A Application

ASIC Relief

- On 29 July 2000, following an application from the Colonial and Commonwealth Responsible Entities, ASIC modified the requirements of paragraph (a)(ii) of Item 7. The modification allows all CFT unitholders to vote in relation to the Item 7 resolutions which form part of the Merger Proposal, other than unitholders who had interests other than as unitholders in the Colonial, Commonwealth and Gandel Funds. (See Annexure D).

- Early on in the proceedings, ASIC provided a statement of reasons for its decision to grant the modification. In its statement, ASIC said it considered that the 656 Application fell within the policy set out in paragraphs 51 to 53 of Policy Statement 74 and therefore it had granted the modification.

- It appears that the modification had not been Gazetted at the time of either of the Applications. It was not referred to in the Colonial notice of meeting or Explanatory Statement.

Submissions

- Mirvac argued that:

- ASIC's modification was beyond power, as ASIC was essentially using it to create a parallel universe of Trust Schemes through its power to modify the takeovers provisions, for which it had no mandate;

- ASIC had not adequately considered section 602(d) of the Act, and the consequent necessity to ensure that a proper (i.e. complying with Chapter 6A) process had been followed prior to compulsory acquisition, when deciding the application;

- in granting the application ASIC had materially adversely affected the interests of the Colonial unitholders by markedly reducing the threshold for compulsory acquisition, without also requiring the higher levels of scrutiny and approval of a Part 5.1 Scheme of Arrangement;

- ASIC had granted the modification without consulting the unitholders, and that ASIC's basis for not consulting the unitholders, i.e. that the Colonial and Commonwealth Responsible Entities' assertions that they were appropriately independent to represent the unitholders' interests in this issue, was inappropriate; and

- Item 7 had never been intended to allow proposals such as the Merger Proposal, especially ones involving compulsory acquisition.

- Colonial and Commonwealth asserted that section 602(d) was not a relevant consideration for ASIC as it was expressly limited to compulsory acquisitions which took place under Chapter 6A of the Act. They further said that the modification was within power and that the width of ASIC's powers had recently been reaffirmed in a number of material judgements.

- Colonial and Commonwealth both asserted that ASIC had frequently granted similar relief. Some of the cases appeared to have been prior to the introduction of the CLERP Act, and there was dispute about the relevance of some of the cases cited. ASIC advised that it was aware of two instances where it had granted similar relief.

Discussion

- The Merger Proposal did not rely on the modification to give effect to the compulsory acquisition and merger. Rather, the modification was to ensure that Chapter 6 did not prohibit the Merger Proposal. The parties accepted that ASIC's modification powers are broad enough for it to have granted the modification.

- The Panel does not agree with submissions that ASIC was expressly required by section 655A to have taken section 602(d) and therefore Chapter 6A into account when considering the application. However, this was clearly a case which involved facilitating compulsory acquisition of securities via another mechanism. In that case, the Panel concluded that ASIC should have considered the implications of the relief and whether it should have required any additional protections as conditions to its relief. To assist in that, it would have been appropriate for ASIC to have compared the compulsory acquisition mechanism which it was facilitating, with the investor protection mechanisms of Chapter 6A and other statutory mechanisms permitting compulsory acquisition, such as schemes of arrangement under Part 5.1. It appears not to have done so.

- By granting the modification, ASIC materially affected the compulsory acquisition procedures for the Colonial unitholders. The related nature of the various fund management entities in the Merger Proposal clearly generated a potential for conflict of interest. On these bases, the Panel concluded that ASIC should not have so easily accepted the assertions of the Colonial and Commonwealth Responsible Entities that they were appropriate persons to represent the interests of Colonial unitholders in submissions concerning whether or not ASIC should grant the modification.

- The Panel does not accept ASIC's submission or ASIC's statement of reasons that Policy Statement 74 stood for any ASIC policy to grant such applications. The Panel considers that the application constituted a difficult area of policy consideration (i.e. the interaction of the takeovers provisions with the operation of "Trust Schemes") for which ASIC had no published or considered policy, and that it should have been treated as such.

Discussion

- Having decided that the decision was within power, the Panel considered the issues of compulsory acquisition and the rights of Colonial Funds unitholders. The Panel considered the submissions it received, especially those from Mirvac being an effective contradictor of the Merger Proposal, and it considered the issues of unitholder protection.

- The Panel considered that in the circumstances of this application, it need not impose any further conditions on the ASIC relief. However, it notes that policy in this area which flows from any working group review may impose different requirements on such relief in future.

- Following its consideration of the relevant policy issues, the submissions it received, and the undertakings given by parties, it decided that it was appropriate to allow the ASIC decision to stand.

Decision

- 66. The Panel does not agree that the ASIC modification was beyond power. Neither does it accept that the Merger Proposal is, in itself, necessarily unlawful. The Panel had some material concerns about the disclosure and potential conflict issues. However, given the undertakings received by the Panel in these proceedings, it decided to decline Mirvac's 656A Application.

Section 657C Application

Discussion

Everest

- The first issue for the Panel was whether the acquisition of 100% of the interests in Colonial First State Property Fund, a Listed Managed Investment Scheme, could only be acquired under a takeover bid pursuant to items 1 or 2 of section 611.

- Mirvac argued that the CLERP Act which brought Listed Managed Investment Schemes under Chapters 6 and 6A of the Act meant that other provisions of the Act which could be used to compulsorily acquire all of the units in a Listed Managed Investment Scheme should be subordinate to Chapters 6 and 6A, and their procedures.

- Specifically, Mirvac argued that section 601GC, which relates to changing the constitution of trusts, should not be used to implement a merger of Listed Managed Investment Schemes.

- Mirvac argued that in introducing Chapter 6A, which relates to the compulsory acquisition of securities, the legislature had set the thresholds under which all compulsory acquisition of units in Listed Managed Investment Schemes should meet.

- We did not accept this aspect of Mirvac's submissions. We considered the application of Chapter 6 and other provisions of the Act in relation to companies. Mergers of companies can be effected by way of the scheme of arrangement provisions of Part 5.1. There has been a line of cases since Re Bank of Adelaide and flowing through Catto v Ampol, Re Nicron Resources, and Re Archaean Gold4 in which the Courts have decided that Chapter 6 is not an exclusive regulatory regime for takeovers and mergers, and there is no indication that they may be conducted only through it. ASIC's Policy Statements in the area also clearly support this proposition in relation to companies. By analogy, where there are legal ways to effect mergers of Listed Managed Investment Schemes, the mere fact of inclusion of Listed Managed Investment Schemes under Chapter 6 does not mean that those other ways are excluded by the existence of Chapter 6.

- There seems no basis to the Panel for asserting that the Merger Proposal should be conducted by way of a Chapter 6 takeover just because the provisions have been legislated allowing takeovers of Listed Managed Investment Schemes under Chapter 6. In the words of Bryson J:

"Chapter 6 procedure is not to be followed merely because it is there; it is not Mt Everest."5

- We saw nothing in the submissions which were made in this matter which indicated that an appropriate majority of properly informed unitholders, similarly to company shareholders in a Part 5.1 company Scheme of Arrangement should not decide whether or not the Merger Proposal proceeded. The issues for the Panel then were :

- what was the appropriate majority;

- should the unitholders vote in (or be counted in) separate "classes";

- if so, what should those classes be; and

- what, if any, additional disclosure was required to ensure that the unitholders were properly informed.

Section 601GC Power

- It was generally accepted that under trust law, at least, section 601GC did give the Responsible Entities power to effect the merger and to compulsorily acquire the Colonial Funds units if the resolutions were passed by the required majorities. The Panel's decision is based on the assumption that section 601GC does enable the Merger Proposal as proposed to proceed.

Previous Use of Trust Schemes

- It was accepted by all parties that Managed Investment Schemes had been merged or acquired under similar mechanisms as the Merger Proposal. In some cases ASIC had granted relief from the strict provisions of Item 7. In other cases it appeared not to have been sought. It was agreed that such Trust Schemes had occurred both pre and post the introduction of the CLERP Act. Colonial provided a list of mergers of Managed Investment Schemes in its submissions that it said had been merged or acquired. The list is attached at Annexure A. Mirvac disputed the relevance of some of the examples cited.

Does the Merger Proposal Involve Compulsory Acquisition?

- Under the Merger Proposal, if the resolutions are passed by the requisite majorities, all units in the Colonial Funds will be transferred to the Commonwealth Responsible Entity and the Gandel Responsible Entity. That will include transfer of the units of those unitholders who either did not vote, or opposed the Merger Proposal. All unitholders in the Colonial Funds will be given either Colonial and Gandel Fund units or cash. The Colonial unitholders will have no alternative and will not be able to resist the transfers (other than by initiating general legal actions).

- The Panel considers that the Merger Proposal will therefore clearly involve a form of compulsory acquisition. Therefore it is proper for the Panel and ASIC to consider the issues and thresholds relating to compulsory acquisition in determining these proceedings and the 656 Application.

Threshold

- There are two "thresholds" under the Merger Proposal. The first is a simple majority (excluding unitholders who had interests other than solely as unitholders in the Colonial, Commonwealth or Gandel Funds) under Item 7. The second is a 75% majority (excluding, under section 253E of the Act, the Colonial Responsible Entity and any of its associates if they have an interest in the resolution other than as a member (of the Colonial Funds)) under section 601GC of the Act.

- Mirvac put it to the Panel that the threshold for approving the compulsory acquisition of the Colonial Funds units was lower than required under a takeover bid and lower than required under a company Scheme of Arrangement.

- Clearly, under a Scheme of Arrangement the threshold for compulsory acquisition is lower than under a takeover bid, so the compulsory acquisition thresholds in Chapter 6A are not the only thresholds that the legislature has chosen to allow for compulsory acquisition. The Panel decided that there clearly is no basis for saying that unacceptable circumstances would occur simply because compulsory acquisition of shares was effected by way of a Scheme of Arrangement. On that basis, provided that a Trust Scheme gives similar levels of investor protection to those afforded in a Scheme of Arrangement it would not be unacceptable to allow compulsory acquisition at approval levels lower than those set out in Chapter 6A.

Alternatives

- The Panel asked the Colonial and Commonwealth Responsible Entities why the mechanism of the Merger Proposal had been chosen in preference to a takeover bid. Their responses indicate to the Panel that there were no reasons preventing the Merger Proposal being conducted by way of a takeover bid, but that it was the proponents' commercial preference to proceed by way of a Trust Scheme.

Comparison with schemes of arrangement

- The Merger Proposal looked more similar to a Scheme of Arrangement for Managed Investment Scheme than a takeover bid. On that basis the Panel sought submissions of the parties on the comparative nature of the Merger Proposal and Scheme of Arrangement.

- On the afternoon of 5 September the Panel sought additional submissions from the parties. The Panel asked whether it should compare the Merger Proposal to a Scheme of Arrangement, should it use the Scheme of Arrangement elements as a benchmark for assessing the adequacy of the Merger Proposal, did the Merger Proposal meet those benchmarks, and if not what changes would be needed.

- The following (modified) table sets out the essential elements.

Colonial Trust Scheme

Chapter 5 Scheme

Takeover

Compulsory acquisition threshold

75% disinterested votes cast

75% disinterested votes cast, 50% by number

90%1

Independent Expert's Report

_

_2

X3

Mandatory ASIC involvement

_

_

X

Meeting to ventilate views

_

_

X

Court approval

X

_

X4

Disclosure requirement: all material information?

_

_

_

Does strict liability regime of section 1041H apply?

_

_

X

(Reduced liability standard of s670A)Do dissentients get access to details of other dissentients?

X

X

_

Right of Appeal to Court against compulsory acquisition

X5

_6

_

- Section 661A(1) also requires that the bidder and its associates acquire 75% (by number) of the securities the bidder offered to acquire under the bid.

- Not always strictly required, but usually issued in Chapter 5 schemes and capital reductions.

- Only required if Bidder commences with stake > 30% or a common director.

- There may be a right to object to Court under Part 6A.1.

- Challenge is feasible but only by initiating action to challenge the validity of the entire merger.

- Either by appearing at the second court hearing, or appealing the decision of the first instance court. Similarly, challenge is only to the Scheme of Arrangement as a whole

- The Panel decided that the Scheme of Arrangement provisions are a useful and sensible benchmark, especially when considered in light of section 411(17) of the Act, the judicial statements and ASIC's Policy Statement and Practice Note in the area which say that it is appropriate for provisions which have similar effect to the takeovers provisions to be administered in an harmonious manner. The Panel notes ASIC's Policy Statement 60 in this regard which states:

- This is based on the attitude of the court that in considering whether the scheme is fair and equitable, and therefore should be approved:

- it is ``legitimate and appropriate for a court to keep in mind the provisions of the Acquisition of Shares Code'' (Catto v Ampol) [now Ch 6 of the Law];

- ``the court keeps before it other legislative provisions including those relating to the regulation of takeovers, and endeavours to administer them in such a way which gives a harmonious practical and mutually supportive operation to each provision'' (Nicron v Catto); and

- ``Thus while such information is not specifically required by the Corporations Law in the case of a court approved scheme of arrangement (or a selective reduction of capital), nonetheless, particularly where what is being done is substantially equivalent to a conventional takeover, shareholders should not be deprived of equivalent information'' (Re Archaean Gold).

- This is based on the attitude of the court that in considering whether the scheme is fair and equitable, and therefore should be approved:

Thresholds

- The "50% by number" threshold of a Scheme of Arrangement does not exist under the Merger Proposal.

Court Scrutiny

- Under the Merger Proposal the court will not scrutinise any aspect of the proposal or transaction. That appears to the Panel to be a material diminution of investor protection compared to a Scheme of Arrangement.

- Courts in Australia have observed that in Schemes of Arrangement the proposal is brought to the Court by the management of the company with no recognised contradictor. Courts have taken this to mean that their role is also to be more careful about their scrutiny of disclosure, mechanisms, classes etc and fulfil the role that a contradictor might take. Similarly, as a Trust Scheme would be put to a meeting of the unitholders on the recommendation of the Responsible Entity there appears to be no person to undertake such a role in Trust Schemes. There also appears to be no person with the role of examiner in Trust Schemes (unless ASIC makes a policy decision to take up that role).

- Indeed, it is the scrutiny of the court in a number of areas which is regularly cited by supporters of Schemes of Arrangement as why it is reasonable and fair for a Scheme of Arrangement to have a lower threshold for compulsory acquisition than a takeover bid.

- The Panel observes that it is common for Australian judges in both Supreme and Federal Courts to scrutinise the scheme documents, the procedures proposed, and even the nature of the proposal very carefully. It appears to the Panel that legal practitioners and others promoting Schemes of Arrangement are acutely aware of such scrutiny and take particular time and care to present to courts documents and proposals that are most likely to meet with the court's approval following such scrutiny.

- That added element of quality control is absent under Trust Schemes.

Voting Classes

- One of the material issues for the court in a Scheme of Arrangement is to assess the proper classes for voting on the proposed scheme. That individual assessment of the different groups, and their differing and similar interests, is also absent from Trust Schemes. Instead there are some more coarse statutory tests for eliminating persons from voting, such as section 253E or Item 7. Judicial assessment of the appropriate division of classes is another area where Trust Schemes, as commonly prosecuted, fall short of the investor protection features of Schemes of Arrangement.

Voting

Related Entities

- As at 2 September 2002, the Associated Unitholders held approximately 138,236,123 or 22.22% of the 622,135,473 Colonial units on issue.

- Of these, 69,972,437 units, or 11.25% of units on issue, were held by or on behalf of the following life companies:

- Colonial Mutual Life Assurance (CMLA) - 69,000,626 units; and

- Commonwealth Life Limited (CLL) - 971,811 units.

- The remaining 68,263,685 units, or 10.97% of units on issue, were held by or on behalf of Commonwealth Group investment schemes, in the following amounts:

- Colonial First State Investments Limited (CFSIL), on behalf of mandated property funds - 3,810,565 units;

- CFSIL, on behalf of property and superannuation funds - 53,024,710 units;

- Colonial First State wholesale funds managed by external managers - 4,972,527 units;

- Commonwealth Funds Management Limited, on behalf of various investment funds - 1,274,271 units; and

- The Commonwealth Responsible Entity, on behalf of various investment funds - 5,181,612 units.

- A discretionary trust associated with Mr John Gandel held 346 units in Colonial.

Restrictions

- The ASIC Item 7 modification uses the words of section 253E of the Act in restricting the voting only of those persons who have interests in the Merger Proposal other than merely as unitholders in the Colonial, Commonwealth or Gandel Funds. Section 253E applies in its own right to the section 601GC resolutions.

- The Explanatory Statement states at page 79 that the Colonial Responsible Entity will disregard the votes of the Commonwealth Responsible Entity and its associates in relation to the Item 7 resolutions6 . Those essentially are the Associated Unitholders. In fact, under the tighter provisions of paragraph (a)(i) of Item 7, the Associated Unitholders are excluded from voting on the Item 7 resolutions. But that is not explained in the Explanatory Statement.

Entitlement to Vote, under the Restrictions

- The Colonial and Commonwealth Responsible Entities noted the fiduciary and statutory obligations owed to persons other than CBA by the Associated Unitholders under section 601FC of the Act and section 32 of the Life Insurance Act 1995 (Life Act) i.e. the unitholders and policy holders of the funds that the Associated Unitholders manage. On that basis, they argued, the Associated Unitholders' interests in the Merger Proposal are solely those of unitholders in the relevant trusts, and that the fact that the Responsible Entities are all subsidiaries of CBA and that the directors of all of the Responsible Entities are appointed by CBA should be discounted.

- The Panel is concerned at the potential conflict of interest position that managers of the funds management and life insurance arms of CBA or similar areas of the Gandel Group may be faced with in deciding how to vote units in Colonial which they control.

- For example, in the scenario that:

- a Responsible Entity of a Managed Investment Scheme is a subsidiary of a holding company;

- the holding company appoints the board of the Responsible Entity;

- its employees' prospects for promotion and remuneration depend on the holding company

- it owes fiduciary duties to the unitholder of that Managed Investment Scheme;

- its holding company is the publicly perceived mover behind a proposed merger of another Managed Investment Scheme;

- the Responsible Entity holds units in the second Managed Investment Scheme;

- those units would almost certainly cause the merger to fail if voted against the proposal;

- the voting against, and the failure of, the merger would likely be the subject of material press coverage;

- press coverage of the merger proposal has stressed the importance of it to the future of the holding company.

It would seem that there is a high likelihood of a public perception of a conflict of interest.

- However, provided that they are reinforced by the undertakings which have been given to it, the Panel considers that the fiduciary or statutory duty that these persons owe to the persons on whose behalf they manage funds will be sufficient to overcome any conflict.

Threshold

- The Panel was not satisfied that it was appropriate, in these particular circumstances, to require a threshold, or voting test, other than the thresholds set out in sections 601GC and 611.

- Specifically, it was not satisfied of any need to add any additional requirement that a certain percentage of units or unitholders vote at the Meetings, nor of any need for a certain percentage of unitholders attending the meetings to vote for the Merger Proposal or for a higher percentage of unitholders to vote for the Merger Proposal.

Decision

- Under the circumstances of this particular proposal, the Panel considers that associates of CBA or the Gandel Group, should not be excluded from voting (or from having their votes taken into account) where those associates have a fiduciary or statutory duty to persons other than the CBA or the Gandel Group of companies. This is subject to the requirement in section 253E of the Act that any person who is an associate of the Colonial Responsible Entity and has an interest other than as a unitholder may not vote.

- To assist this, the Panel received undertakings that

- the Associated Unitholders that are related entities of CBA:

- will ensure that the decision as to voting are made by the boards of the relevant bodies; and

- that the bodies will exercise the votes of units held by them in accordance with their duties under the Life Act (including without limitation section 32 of that Act), or section 601FC(1)(c) and section 601FA of the Act, as appropriate; and

- the directors of those bodies who make the decisions as to the voting of the Colonial Funds units that the Associated Unitholders hold will provide undertakings to the Panel that they will similarly comply with their obligations under section 48 of the Life Act and section 601FD of the Act, as appropriate.

- the Associated Unitholders that are related entities of CBA:

- The Panel also received an undertaking that the 346 units in the Colonial Funds held by a trust associated with the Gandel Group will not be voted at the Meetings.

- The Panel also required an undertaking that a record of the voting on the resolutions will be kept, separately identifying votes cast by associates of CBA or Gandel, and a summary of that record will be included in the notice of resolution lodged with ASIC.

- A proforma of the relevant undertakings is at Annexure B.

Disclosure

- The Panel considered that there were some material deficiencies in the Explanatory Statement. Accordingly, the Panel required the Colonial Responsible Entity to send to its unitholders a supplementary notice setting out, as a minimum, the following issues:

- Full disclosure of the relationship to CBA and the Gandel Group of any unitholders in the Colonial Funds which are related to CBA or the Gandel Group;

- A statement concerning the undertakings to be made by Associated Unitholders and their directors;

- A statement clarifying the effect of the liability disclaimers purported to be made in the Explanatory Statement and disclosing clearly that such purported disclaimers do not reduce any statutory liability imposed under the Corporations Act, and clearly explaining the limit of the effect of the disclaimers;

- Disclosure of the effects on the amount of trust management fees payable to the Responsible Entity of the Commonwealth funds in the event that the Merger Proposal is approved and the Colonial First State Property Fund and Gandel Retail Trust come under its management. The Panel also requires that the relationship of the Commonwealth and Colonial Responsible Entities with each other and with CBA be clearly disclosed in relation to these effects;

- A full explanation of the effect of all changes to the fees and charges of the Responsible Entity of the two ongoing trusts, as of the date of the supplementary notice.

- The Panel required undertakings that this information will be posted to unitholders of the Colonial Funds at least ten days before the date of the further postponed Meetings.

- A copy of the undertaking from the Colonial Responsible Entity is at Annexure C.

Disclosure of the CBA Relationship and Undertakings

- The Panel considered that the Merger Proposal was not solely a proposal generated for the benefit of the unitholders of the relevant trusts, but also falls within a much larger market context of rationalisation of the funds management industry in Australia, of which CBA has publicly stated its ambitions to be a material player. On that basis, the Panel considered that relationships between the relevant Responsible Entities and both CBA and the Gandel Group was a material issue and context for unitholders to make their decisions, and that it had been inadequately addressed in the Explanatory Statement.

- The Panel had required the undertakings from the Associated Unitholders because of its concerns for the potential for conflict of interest that the related nature of the various Responsible Entities generated. On that basis it required that the existence and nature of the undertakings be disclosed to unitholders of the Colonial Funds in order for the unitholders to be aware of the potential for conflict when making their decisions.

Liability Disclaimer

- On the inside cover of the Explanatory Statement the Colonial Responsible Entity made the following statement:

"While all reasonable care has been taken in relation to the preparation and collation of the information no person, including (the responsible entity) or any other member of the Commonwealth Bank of Australia group of companies, accepts responsibility for any loss or damage however arising resulting from the use or reliance on the information by any person.""

The disclaimers on the inside cover also included other, perfectly proper statements concerning investment risks, forecasts, the lack of guarantees as to future performance, and warnings to seek appropriate advice if in doubt.

- However, the statement purporting to disclaim responsibility for the contents of the Explanatory Statement was unacceptable.

- The statement was even less satisfactory when considered in the light of an argument put to the Panel in the proceedings by Freehills, when acting for the Colonial Responsible Entity. Those submissions included as a reason for the Panel to find that unacceptable circumstances did not exist the fact that a strict liability regime exists for disclosures in explanatory statements provided to unitholders. The argument was put to the Panel that this liability regime is in fact more rigorous than the liability regime imposed under the takeovers provisions.

- The inclusion of the statement was both false and misleading. The Panel's concerns were reduced by paragraph 1.(c) of the undertaking given by the Colonial Responsible Entity.

Effects of the Merger Proposal on the management fees of the Commonwealth Responsible Entity

- One of the material effects of approving the Merger Proposal would be to enlarge the value of funds managed by the Commonwealth Responsible Entity, and consequently the fees payable to it. That would occur through both the acquisition of the Colonial Funds and the Commonwealth Responsible Entity taking over the funds management role for the Gandel Fund (albeit with a sub-contract to the Gandel Group to be property manager).

- The Panel was concerned that this was a material commercial issue which had not been addressed in the Explanatory Statement. In particular, the Panel noted that section 411(3) and the Corporations Regulations specifically require the disclosure of the particular interests of those promoting a Scheme of Arrangement. The Panel's concerns were addressed by paragraph 1(d) of the undertakings provided by the Colonial Responsible Entity.

Explanation and Consolidation of the "Enhancements"

- The Explanatory Statement sets out a number of changes to the management fees, payout ratios, management fee calculations and other items relevant to the return unitholders of the Colonial Funds might expect if they approve the Merger Proposal. Those changes are significant and complex, although well explained in the Explanatory Statement.

- Subsequent to the dispatch of the Explanatory Statement, Mirvac announced its bid, and the Commonwealth Responsible Entity and the Gandel Group have announced a number of changes to the terms of the Merger Proposal, including issues relating to management fees. The Panel considered it was sensible for Colonial Funds unitholders to be given a consolidated explanation of the various enhancements offered by the Commonwealth Responsible Entity and Gandel Group in any supplementary notice of meeting.

- The Panel's concerns were addressed by paragraph 1.(f) of the undertakings provided by the Colonial Responsible Entity.

Directors' Recommendation

- Mirvac submitted that the Panel should require the directors of the Colonial Responsible Entity (Colonial Directors) to provide in the supplementary notice of meeting an updated recommendation to Colonial Funds unitholders, and to provide their reasons for that recommendation. Mirvac asserted that the Colonial Directors had not set out their reasons for recommending in favour of the Merger Proposal. The Colonial Responsible Entity asserted that the Colonial Directors' reasons were set out clearly throughout the Explanatory Statement, and specifically were based on support from the independent expert's report from BDO Corporate Finance P/L (BDO) as to the fairness and reasonableness of the Merger Proposal for Colonial Funds unitholders.

- The Panel considered that the changes in disclosure required by the Panel, the enhancements offered under the Merger Proposal and the introduction and enhancement of the Mirvac proposal meant that the Colonial Directors should provide an updated recommendation in the supplementary material which CFSMPL has proposed to provide to Colonial's unitholders. The Panel also considered that the Colonial Directors should provide their reasons for such recommendation. The Panel bases this on:

- the test for the disclosure obligations in the relief granted to Commonwealth Property Office Fund (CPA) and Gandel Retail Fund (GAN) from the prospectus provisions for the Merger Proposal, which requires CPA and GAN to provide all information which Colonial unitholders and their advisers would reasonably require;

- the common law requirement that CFSMPL provide all information which is available to the company which is material to the unitholders' decision whether to vote for or against the Merger Proposal;

- ASIC Policy Statement 74 in relation to the information required to be provided to Colonial unitholders under an Item 7 resolution, which relevantly requires that:

[PS 74.9] Shareholders of a company should also be provided with:

- the identity of the directors who approved or voted against the proposal to put the resolution to shareholders and the relevant information memorandum;

- the recommendation or otherwise of each director as to whether non-associated shareholders should agree to the acquisition, and the reasons for that recommendation or otherwise; and

- The equivalent provisions in the takeovers disclosure regime, which must inevitably set some form of benchmark against which the Panel should consider in any consideration of whether or not circumstances in relation to the affairs of Colonial constitute unacceptable circumstances.

- The Panel did not consider it appropriate for it to determine the form of wording that the Colonial Directors use to provide their recommendation and their reasons. However, it considered that the recommendation and reasons should be clearly discernible by Colonial unitholders as being the Colonial Directors' recommendation and reasons.

BDO Report

- The Explanatory Statement included an independent expert's report setting out BDO's opinion as to whether the Merger Proposal was fair and reasonable to the Colonial Funds unitholders. That report, necessarily was based on the circumstances as at the date of the notice of meeting, and did not consider the Merger Proposal in light of the enhancements offered by the Commonwealth and Gandel Responsible Entities or the Mirvac takeover announcement.

- The Colonial Responsible Entity requested BDO to provide a limited supplementary report on the revised Merger Proposal and the Mirvac proposal. BDO noted in its report of 29 August the restricted nature of its review in the following terms:

You have requested BDO to restrict our assessment to a comparison of limited scope valuations of the offers only. This restriction has been requested due to the limited time available to BDO to complete a full assessment and the Fact that Mirvac has not released its Bidder's Statement as this point. Accordingly, BDO does not have access to full details and implications of Mirvac's offer under the takeover provisions of the Corporations Act, 200 1.

Due to this limitation in scope, this report is not an independent experts report commenting on whether the Mirvac Offer is fair and reasonable or whether the supplementary GANKPA Offer is fair and reasonable. All issues in relation to qualitative assessments have been excluded from BDO's scope. Such assessment would normally be defined under the "reasonableness" heading of an independent expert's report.

- Mirvac requested that the Panel order the Colonial Directors to instruct BDO to provide a fully revised report to Colonial unitholders in light of the Mirvac proposal and the subsequent variations to both the Merger Proposal and the Mirvac proposal. Mirvac noted that thus far BDO has only been instructed by the Colonial Directors to prepare a restricted review of its conclusion and opinion.

- The Panel did not consider it appropriate to require the Colonial Directors to instruct BDO this way. The Panel considered that it is currently fully within the discretion of the Colonial Directors to choose whether or not to do so.

- The Panel notes that the Colonial Directors, in their initial recommendation stated that their recommendation was supported by the conclusions of the Independent Expert. The weight which the Colonial Directors will be able to place on the Independent Expert's conclusion in any future recommendation to Colonial unitholders will clearly depend on the currency and breadth of any then existing report by BDO. On that basis, the Colonial Directors should not make any recommendation that is stronger than the then currently updated report would allow, if they wish to base or support their recommendation on such independent reports.

- The Panel noted that the Mirvac bidder's statement was due to be given to ASIC and the Colonial Responsible Entity in the near future, and following that, the Colonial Directors will be required to prepare a target's statement. If the Colonial Directors choose, or are required, to provide an Independent Expert report with the Colonial target's statement that will provide an updated assessment of the merits of the Mirvac bid.

Settling of Disclosure Issues

- The Panel required Colonial to settle the terms of any proposed disclosure and to give Mirvac at least 12 hours to review the disclosure before it was printed.

- The Panel encourages any steps which the Colonial Responsible Entity might take to arrange the timing of the distribution of the additional material to unitholders in a way that assists unitholders to deal with the large volume of information that they will be receiving from the Colonial, Commonwealth, Gandel and Mirvac Responsible Entities.

Proxies

- Mirvac submitted that, because of the deficiencies identified by the Panel in the Explanatory Statement as dispatched, all proxies lodged so far for the Meetings should be determined to be invalid and unitholders be required to submit fresh proxies. The Panel does not accept this.

- However, the Panel considered that given the passage of time, the additional information to be provided and the changes in the Merger Proposal and the Mirvac proposal, the Colonial Responsible Entity should, in its supplementary notice of meeting, provide fresh proxy forms to all unitholders.

- The Panel considered that the Colonial Responsible Entity should also advise that Colonial unitholders who have already lodged proxies should consider their proxies in light of the supplementary disclosure, and that lodging a fresh proxy will automatically revoke any earlier proxy, and that attending the Meetings in person will suspend the authority of a proxy to speak and vote for that unitholder.

- The Colonial Responsible Entity provided an undertaking (paragraph 3(b)) to resolve this issue.

Timing of the merger proposal and the Mirvac proposal

- Mirvac asserted to the Panel that in order for the Colonial Funds unitholders to be fully informed when they voted at the Meetings, the Panel should order the meetings to be postponed until after the Mirvac bidder's statement and the Colonial Funds target's statement had been given to the Colonial Funds unitholders.

- The Panel agrees that, in the best of worlds, the Colonial Funds unitholders would have all such information before them when voting at the Meetings. However, in competitive commercial situations such as the one before the Panel, there is no statutory requirement for the Colonial Directors to delay the Meetings for what could be a long period. The Panel notes by comparison, that under the Act there is no requirement that a bidder keep its bid open to overlap with a rival bid which has been announced but will not commence prior to the scheduled closing date of the first bid.

- The decision as to whether or not to postpone the Meetings is one for the Colonial Directors and their fiduciary duties to the Colonial Funds unitholders. Where only a small postponement, from an already postponed date, was required to materially increase the information available to unitholders, the Panel considers it would be good practice for a Responsible Entity to look to maximise the information available to unitholders when making their decisions. This would be especially the case where unitholders were faced with two competing proposals and the Responsible Entity owed its obligations to unitholders to remain independent and interested solely in its unitholders' interests.

Decision

- On Friday 6 September 2002, the Panel reached a number of preliminary decisions in relation to the applications, but delayed any decision on whether or not to make a declaration of unacceptable circumstances or orders until parties had had an opportunity to resolve the Panel's concerns. The Panel's concerns have been set out above.

- By Wednesday 11 September, the parties had provided all of the undertakings that were necessary to resolve the Panel's concerns. On that basis, the Panel decided to:

- accept the undertakings;

- affirm the ASIC section 656A decision; and

- decline to declare circumstances to be unacceptable in relation to the affairs of the Colonial Funds.

Future Policy

- The Panel notes that the issues raised in this application go to some fundamental questions as to the mechanism of mergers of Managed Investment Schemes by "Schemes of Arrangement". The Panel considers that it would be desirable for the market for a more definite policy framework and mechanism for such mergers to be published. It appears desirable to the Panel that these issues should be considered in a broader context than simply the facts of this application, and that the process of consideration should be open to public consultation.

- The Panel notes that such mergers might, as they are in company mergers, be conducted either by acquisition and transfer as in this case, and requiring ASIC relief, or by redemption and re-issue, which would not require ASIC relief. In order to ensure that different mechanisms with similar effect are governed by similar policy and requirements, the Panel proposes to work with ASIC to develop guidelines for ASIC relief for transfer schemes and Panel guidance on what would constitute unacceptable circumstances under redemption schemes. Accordingly, it will forward these issues to a working group to develop appropriate policy in this area. The Panel has invited ASIC to make the working group a joint project. ASIC has agreed to participate in an initial scoping meeting to discuss the terms of reference of the proposed working group and to enable it to consider whether it is appropriate for ASIC to participate in such a group. The public policy process, combined with the special facts of this matter, will very likely limit the value of this decision as precedent.

Timing of Proceedings

- Colonial and Commonwealth announced the Merger Proposal on 30 July 2002 and distributed the notice of meeting and Explanatory Statement on or about 7 August. Mirvac announced its intention to make its bid on 27 August. Mirvac applied to the Panel on Friday 30 August. The Meetings were then planned to be held on Tuesday 3 September.

- Colonial and Commonwealth asserted that the timing of the explanatory memorandum application was tactical, and that the Panel should discount the application and any relief accordingly.

- The Panel took no view on these assertions. However, it repeats its earlier statements that as the time within which an application allows the Panel to consider and makes its decision shortens, and the time within which an applicant has had to make an application lengthens, the onus falls more heavily on an applicant to prove its case and to demonstrate the harm that its application will prevent. Given the cooperation of the parties, the Panel was able to consider the application in the relevant time period.

- The Panel discussed timing issues with the parties. They all agreed to use material endeavours to complete the proceedings as quickly as possible to give the Panel an opportunity to conclude its proceedings, if possible, on the afternoon of Friday 6 September. By that time the Colonial Responsible Entity had voluntarily postponed the Meetings from 3 September to 10 September. To that end, the Panel provided a brief to parties on Tuesday 3 September and they provided submissions by 3.00 p.m. on Wednesday 4 September and rebuttals on Thursday 5 September.

- The Panel met on the afternoon of Friday 6 September. It decided that there were material issues of disclosure and voting which would not be able to be resolved that afternoon, and advised parties. The Colonial Responsible Entity announced that it would postpone the Meetings further.

- On the evening of Friday 6 September, the Panel advised parties of its concerns and offered to accept undertakings to resolve those concerns rather than making a declaration of unacceptable circumstances and orders. The last of those undertakings was provided by parties on the morning of Wednesday 11 September.

- The Panel wishes to thank all the parties involved for making very significant efforts to resolve this application so expeditiously.

- The Panel consented to the parties being represented by their commercial solicitors in the matter.

Ian Ramsay

President of the Sitting Panel

Decision dated 12 September 2002

Reasons published 10 October 2002

Annexure A - Trust Scheme Deals

Post-March 2000

|

Parties |

Date of explanatory memorandum |

|

Flinders Industrial Property Trust / Property Trust of Australasia |

21/11/01 |

|

Macquarie Office Trust / 2 Park Street Trust |

15/11/01 |

|

GPT Management Ltd / Homemaker Retail Group |

10/10/01 |

|

James Fielding Holdings Ltd / PA Property Trust |

8/10/01 |

|

Mirvac Property Trust / Mirvac Commercial Trust |

20/09/01 |

|

Stockland Trust Group / Australian Commercial Property Trust |

6/07/01 |

|

Prime Retail Group / CT Retail Investment Trust |

21/05/01 |

|

Wesfarmers Ltd / Franked Income Fund |

2/03/01 |

|

Goodman Hardie Industrial Property Trust / Macquarie Industrial Trust |

28/09/00 |

|

Industrial Investment Trust / Paladin Industrial Trust; Commercial Investment Trust / Paladin Commercial Trust |

25/07/00 |

|

BT Office Trust / BT Property Trust |

12/07/00 |

|

AMP Office Trust and General Property Trust/Darling Park Trust |

28/04/00 |

|

Meridian Investment Trust / Tyndall Property Trust |

12/04/00 |

Pre-March 2000

|

Parties |

Date of explanatory memorandum |

|

Colonial First State Property Group Ltd / Colonial First State Retail Property Trust, Colonial First State Commercial Property Trust, Colonial First State Industrial Property Trust, Colonial First State Development Trust |

13/11/99 |

|

Prime Credit Property Trust / Armstrong Jones Office Fund |

16/11/99 |

|

Prime Industrial Property Trust / Armstrong Jones Industrial Fund |

16/11/99 |

|

Mirvac Ltd / Mirvac Property Trust, Capital Property Trust |

30/04/99 |

Annexure B - Pro-forma Associated Unitholders Undertakings

ON [ ] LETTERHEAD

10 September 2002

Takeovers Panel

Level 47

Nauru House

80 Collins Street

MELBOURNE VIC 3000

Fax: (03) 9655 3511

Dear Sirs

Colonial First State Property

For the purposes of section 201A of the Australian Securities & Investments Commission Act 2001, [ ] ([ ]) hereby undertakes in relation to units in Colonial First State Property Trust Group (CFT) held by or on behalf of [ ] (the Units):

- to vote the Units, or cause the Units to be voted, at a meeting of CFT unitholders to consider the merger proposal between CFT, the Gandel Retail Trust and the Commonwealth Property Office Fund, in accordance with its duties under the Life Insurance Act 1995 (Cth) (including without limitation section 32 of that Act);

- that the decision on how it will vote its Units, or cause those Units to be voted, in the circumstances referred to in paragraph (a) above, will be made by the Board of [ ]; and

- that prior to deliberating on the decision referred to in paragraph (b) above, each member of the Board of [ ] that is to participate in the deliberation and decision will provide the Panel with an undertaking in the form attached to this undertaking.

For and on behalf of [ ]

[ ], Director

[ ], Director

FORM OF BOARD MEMBER UNDERTAKING

[insert date ] 2002

Takeovers Panel

Level 47

Nauru House

80 Collins Street

MELBOURNE VIC 3000

Fax: (03) 9655 3511

Dear Sirs

Colonial First State Property

For the purposes of section 201A of the Australian Securities & Investments Commission Act 2001, each signatory to this undertaking, being a member of the Board of [ ], hereby undertakes to comply with his or her obligations under section 48 of the Life Insurance Act 1995 (Cth) in relation to the making of the decision as to how units in Colonial First State Property Trust Group (CFT) held by or on behalf of [ ] are voted at a meeting of CFT unitholders to consider the merger proposal between CFT, the Gandel Retail Trust and the Commonwealth Property Office Fund.

[ ], Director

[ ], Director

[ ], Director

[ ], Director

Annexure C - Undertaking from the Colonial Responsible Entity

Undertaking by CFS Managed Property Limited to the Takeovers Panel.

In these undertakings, Adjourned Meeting means the meeting of the members of the listed managed investment schemes set out in Schedule 1 (Colonial) originally convened for 9 am on 10 September 2002 and which has been adjourned by Colonial for an undetermined period.

CFS Managed Property Limited ACN 006 464 428 (CFSMPL), as the responsible entity for Colonial undertakes to the Takeovers Panel:

- CFSMPL will, not later than 10 days before the date on which the Adjourned Meeting is to be held, dispatch to the members of Colonial a supplementary notice including:

- to the extent it is actually known by the directors of CFSMPL, in relation to each member of Colonial which is a related body corporate of:

- Commonwealth Bank of Australia (CBA), full disclosure of the relationship of that member to CBA; and

- the Gandel group of companies( Gandel Group), full disclosure of the relationship of that member to the Gandel Group;

- a statement to the effect that each member of Colonial which is an associate of one or more of CFSMPL, CBA or the Gandel Group and which holds Colonial units under fiduciary or statutory obligations has been requested by the Panel to provide CFSMPL, the Panel and the Australian Securities and Investments Commission (ASIC), before the time for the time for lodging of proxies for the Adjourned Meeting, the following undertakings:

- an undertaking by each of the relevant associates that the decision on voting would be made at a board level; and

- a personal undertaking by each director who participated in the deliberations and decision on the vote that in doing so:

- in the case of the Responsible Entity Associates, they complied with the requirements of s601FD(1) of the Corporations Act 2001; and

- in the case of the Life Associates, that they complied with s48 of the Life Insurance Act 1995;

and a disclosure describing any such undertakings received by CSFMPL on or before the date of the supplementary notice;

- a statement clarifying, and clearly explaining the limit of, the effect of the liability disclaimers made in the Explanatory Statement dated 30 July 2002 and disclosing clearly that those purported disclaimers do not reduce any statutory liability imposed under the Corporations Act 2001 in relation to misleading or deceptive conduct constituted by the Explanatory Statement;