[2002] ATP 5

Catchwords:

Concurrent court and Panel proceedings - disclosure of Panel submissions in Court proceedings - underwritten issue of shares - related party

Corporations Act 2001 (Cth), sections 606, 610, 611 items 10 and 13

Australian Securities and Investments Commission Act 2001 (Cth), sections 197 and 186

NCSC Policy Statement 112 (Issue 3)

ASIC Policy Statement 61

These are our reasons for refusing an application by Westgold Resources NL (Westgold) for an interim order, a declaration of unacceptable circumstances and final orders in relation to acquisitions of shares by entities related to some of the directors of Precious Metals Australia Ltd (PMA ) under an entitlement issue by PMA.

- The sitting Panel is made up of Elizabeth Alexander AM (sitting President), Kathleen Farrell (siting deputy President) and Luise Elsing.

Summary

- After deciding in good faith to conduct proceedings on this matter, we dismissed the application after Westgold subsequently commenced separate proceedings in the Western Australian Supreme Court. Those proceedings were in relation to the related party and prospectus provisions of the Corporations Act. They covered many of the same facts and issues of these proceedings. We dismissed this application on the basis that it would be inappropriate to allow it to continue in parallel with Supreme Court proceedings between the same parties, concerning the same facts and overlapping issues.

Background

- PMA is a company listed on ASX. Its present business consists of holding a royalty interest in a vanadium mine at Windimurra, operated by Xstrata AG. It is resisting an action in the Supreme Court of Western Australia brought by Westgold against PMA and some of the directors personally, concerning disclosures in relation to a placement of shares by PMA to Westgold in 2000 (the Placement Proceedings).1 PMA has only one employee and its directors are non-executive.

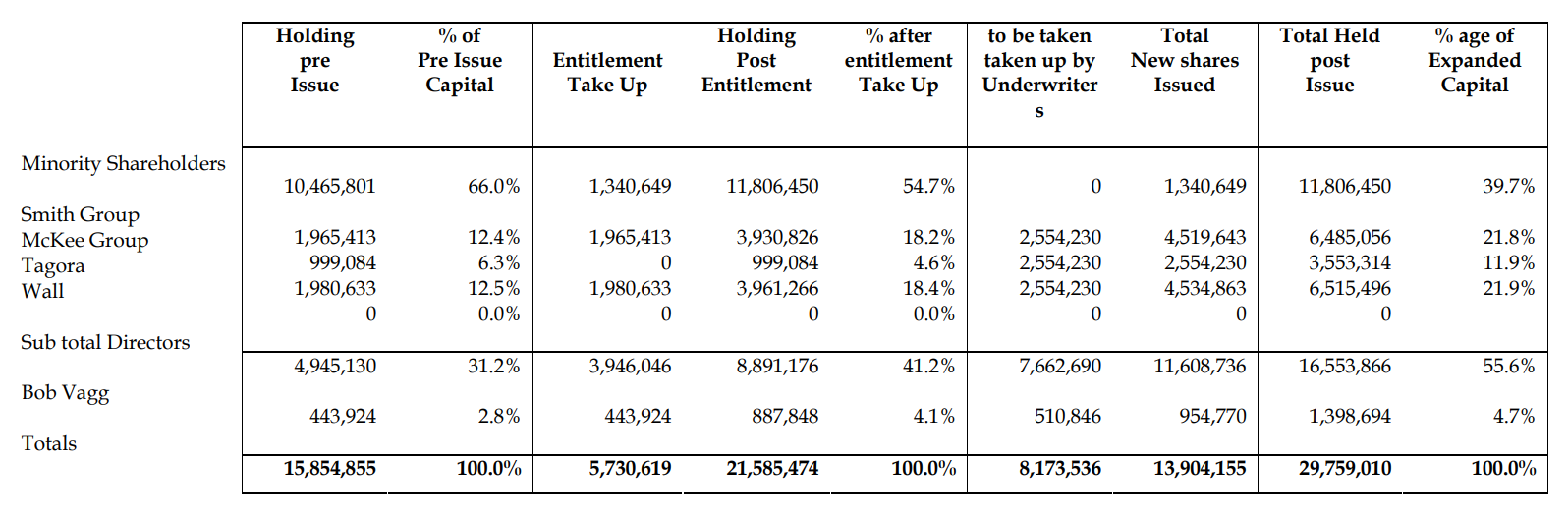

- PMA has 15,854,485 fully paid ordinary shares on issue. It has four directors, Messrs Greville (the Earl of Warwick), McKee, Smith and Wall. The directors and related companies at present hold an aggregate of approximately 30% of the shares. Their existing and projected holdings are set out in a table provided by PMA, which is attached.

The Underwritten Entitlement Issue

- PMA issued a prospectus dated 6 February 2002 offering additional shares to its existing shareholders in the ratio one for one, on a non-renounceable basis. The price is 10 cents per share, which is at the lower end of recent market prices for shares in PMA2 . The offer opened on 20 February 2002 and closed on 8 March 2002. A supplementary prospectus was issued to ASX on 18 February 2002.

- The issue is underwritten pursuant to 3 underwriting agreements with entities associated with three of the directors (Messrs Smith, McKee and Greville), as to 4 million shares each (about 25% each of the total proposed issue), and by a company associated with Mr Robert Vagg, a shareholder not represented on the board, as to another 5%. of the total proposed issue 3 Each underwriter is entitled to a 5% underwriting fee. None of the underwriters committed to take up their entitlement under the issue, although Messrs Smith and Greville (and entities associated with them) in fact did so. Westgold has raised no issue about Mr Vagg's underwriting.

Director Loans

- The prospectus states that companies associated with Messrs Smith and McKee have advanced funds to PMA, and that PMA owes them a total of $553,606 in loans, capitalised interest and fees. It also owes Messrs Smith and McKee $206,627 in relation to previous employment with the company as executive directors. It also states that those amounts were current liabilities at 31 December 2001, but that Messrs Smith and McKee and their associated companies agreed not to demand payment before 30 September 2002, subject to the company being able to repay the money at an earlier time.

- The prospectus indicates that these amounts will be repaid from the proceeds of the issue. The underwriting agreements in fact require them to be paid at the same time as the subscription money under the underwriting and permit the underwriters to offset the amounts owing against the subscription money.

Acquisitions under the Underwriting

- The issue was undersubscribed (applications are shown in the table), and the company has called on the underwriters. If shares are issued in accordance with the applications and the underwriting obligations, the holdings of the directors, together with their associated companies, will increase as set out in the table.

- According to the information provided by PMA to us on the outcome of the offer, Messrs Greville and Smith (together with their respective associated companies) will each have voting power in their own right of just under 22%, Mr McKee and his company will have voting power of 11.9% and the sum of the voting powers of the directors and their respective associated companies will be 55.6%.

- It appears to be common ground that the acquisitions will not contravene section 606, because they will fall within item 10 or 13 of section 611 (underwriting a prospectus or a rights issue). Given the stage at which this application was dismissed and the reason for dismissing it, we made no finding on the issue whether the directors' respective voting powers should be aggregated under section 610.

Whether Unacceptable

- Westgold submits that the increased holdings and voting power of the directors will be acquired under unacceptable circumstances. Westgold relies on policy published by ASIC and its predecessors: NCSC Policy Statement 112, Issue 3, and ASIC Policy Statement 61.4 .

- Policy Statement 112 raises a large number of considerations as possibly relevant to whether unacceptable circumstances result in a particular case from an acquisition in reliance on the exception now in item 13 of section 611. Among them are the intentions of the relevant company and the underwriter, whether the pricing of the issue was contrived so as to discourage shareholders from subscribing, whether the underwriter was already aligned with the directors or controllers of the company, the company's need for funds, whether there were alternative sources of funds, and whether there were alternative ways of structuring the capital raising.

- Westgold submit that the following are facts and that they (amongst others) establish that unacceptable circumstances exist.5

- the directors will derive benefits from the issue which are not available to other shareholders, because:

- amounts owing to directors will be paid out of the proceeds of the issue before they are due to be paid,

- the net amount of cash the company will receive from Mr Smith and his company is relatively small, and Mr McKee and his company will actually receive $14,761 net,

- they also receive the underwriting commission of 5%, and did not commit to take up their entitlements,

- the net amount of cash to be raised for the company's operations is comparatively small,

- association between the directors, evidenced by their co-operation in underwriting the issue,

- the debts to the directors, and the proposed repayment, are on uncommercial terms,

- the debts to the directors were contracted, and would be repaid, and the underwriting arrangements with the directors were entered into, in breach of related party provisions of Chapter 2E of the Corporations Act,

- none of these arrangements (entry into the debts, the underwriting or repayment of the debts) or the issue itself have been approved by a meeting of the company, and

- deficiencies of disclosure in the prospectus, particularly in relation to the matters listed above.

- the directors will derive benefits from the issue which are not available to other shareholders, because:

- PMA has denied any association between the directors. PMA has not responded fully on these points, because, after Westgold initiated its proceedings in the Western Australian Supreme Court, we invited them to limit their submissions to certain specific issues which were expressly narrower than the scope of the application. We have made no findings on any of these points or on whether we would have declared the circumstances of the underwriting unacceptable on a consideration of those factors.

Related Party Issue

- The related party point arises as follows. The loans and other transactions giving rise to the company's debts to the directors and the underwriting, being transactions between a company and its directors and entities they control, are related party transactions for the purposes of Chapter 2E. Briefly, Chapter 2E forbids a public company to engage in material financial transactions with related parties (including directors and companies they control) unless:

- the transaction is on no better terms for the related party than terms on which the company could reasonably have dealt with a party at arm's length, or

- the terms have been approved by non-associated shareholders.

- Westgold alleges that the terms of the loans cannot be upheld as being on arm's length terms and were not approved by shareholders. They say the same will apply to the repayment of the loans before they are due. Even if these alleged contraventions were established, they would not fall within the Panel's jurisdiction. Some of the facts relevant to this issue would also be relevant to a finding about whether unacceptable circumstances occurred, because of differential benefit.

- The remedies sought by Westgold were an interim order to prevent shares being issued under the prospectus or the underwriting, a declaration of unacceptable circumstances in relation to the affairs of PMA,6 an order that shares not be issued under the prospectus unless a supplementary prospectus is issued and applications are confirmed and an order that shares not be issued under the underwriting, without approval at a company meeting.

Progress of the Matter

- The application was made on 6 March, two days before the prospectus was due to close. On 8 March, PMA undertook to us through its solicitors not to issue shares without giving us 48 hours notice of its intention to do so. Accordingly, we made no interim order.

- On 11 March, PMA made submissions (the preliminary submissions) to the effect that the Panel should decline to commence proceedings under ASIC regulation 20. Consistently with the Panel's rules, the preliminary submissions were copied to Westgold's solicitors and to ASIC.

- Those submissions contained an extensive analysis of whether the application fell within the Panel's jurisdiction, whether it was made within time, overlap with Court proceedings, overlap with ASIC investigations, Westgold's motives in bringing the application and whether it would be an appropriate exercise of discretion to grant relief. They were supported by copies of notices issued by ASIC and of correspondence between PMA's solicitors and ASIC, containing confidential information concerning the rights issue and the underwriting. This was received contemporaneously with our decision to proceed and was not taken into account in relation to that issue.

- On 13 March, the Panel issued a brief under ASIC regulation 20, seeking submissions on a number of matters relevant to the application by close of business on Monday 18 March. If it decides to conduct proceedings, the Panel must issue a brief, setting out a general description of the matters to be examined in the proceedings and the issues to be addressed in submissions in the proceedings.7

- The brief in this matter was wide-ranging, and touched on many of the issues relevant to the NCSC policy mentioned above. These included the motivation of the company and of the underwriters for the issue and its pricing and timing, the company's need for funds, alternative sources of funds, the terms on which underwriting could be obtained and the effect of the issue on voting power in the company. Full and candid submissions on all of these issues and related facts would have disclosed a great deal of information confidential to PMA.

Parties' Undertakings for Confidentiality

- In making its application, Westgold undertook via its solicitors that it would not use or disclose any confidential information it learned through the proceedings for purposes other than those of the proceedings. By 13 March, notices of appearance had been filed by ASIC and by PMA. The notice of appearance filed by PMA contained an undertaking for confidentiality corresponding with that given by Westgold in its application. ASIC is not required to give an undertaking for confidentiality, as its obligations are codified in section 127 of the ASIC Act.

- Undertakings for confidentiality are a standard requirement of the Panel's rules, imposed pursuant to sections 127 and 186 of the ASIC Act8 . They are designed to allow parties to be candid with the Panel in matters which will frequently involve sensitive commercial information, where that information is in fact confidential and parties are under no obligation to disclose it until and unless compelled, for instance by a summons under section 192 of the ASIC Act.

- In practice, the great bulk of information which is provided to the Panel in its proceedings is provided voluntarily, in response to offers to hear submissions to accord procedural fairness, and not under summons. This practice is important to the efficient operation of the Panel and the Panel is concerned to ensure that it not be undermined by any party using information received in this way for other purposes.

The Prospectus Proceedings

- On 15 March, PMA's solicitors advised the Panel that Westgold had that day issued proceedings against PMA in the Supreme Court of Western Australia (the Prospectus Proceedings) challenging the adequacy of disclosure in the prospectus of 6 February 2002 and seeking orders that no issues be made pursuant to the prospectus (without a supplementary prospectus) or the underwriting (without shareholder approval under Chapter 2E).

- The alleged deficiency of disclosure in the prospectus relates to:

- issues in and concerning the Supreme Court proceedings, in particular whether PMA has rights of contribution, set-off or other causes of action against the directors, and

- the terms of the loan agreements and the proposed repayments, in particular whether they are related party transactions between the directors and the company9 .

- Westgold had also lodged affidavits in those proceedings to which were annexed the preliminary submissions made to the Panel on behalf of PMA. We asked Westgold's solicitors how this had happened and how they reconciled their affidavits in the Supreme Court proceedings with their undertaking to the Panel. They recited a duty of utmost good faith to the Court (because they were initially seeking interlocutory relief) and undertook to seek orders preserving the confidentiality of the Panel material, when their affidavits were read to the Court.

- We note that the affidavits would normally be read in open court, and that whether to make orders for confidentiality is up to the Court's discretion. The undertaking that Westgold has given in no way restrains, or in the circumstances could restrain, disclosure of the annexures to the Court itself. Neither Westgold nor its solicitors have undertaken not to disclose to the Court any further materials derived from these proceedings.

Limited Submissions

- When we learned that the preliminary submissions had been disclosed, submissions on the brief were due on 18 March and submissions in rebuttal were due on 19 March. In view of the disclosure, we invited parties to limit those submissions to two related issues, namely whether the directors (and their associated companies) were at the relevant times associated within the meaning of section 12 of the Act, or had relevant interests in one another's shares, within the meaning of sections 608 and 609. Submissions made by PMA were limited in this way.

- The submissions we have received to date (i.e. PMA's preliminary submissions and the submissions on the brief and submissions in rebuttal) do not deal with all of the issues we set out in our brief, for reasons set out above. Nor do they enable us to decide on the application on the merits. We have decided, however, that it would be inappropriate for us to deal with this application on the merits, because it would be contrary to the public interest to continue these proceedings, which substantially duplicate part of the Prospectus Proceedings.

Substantial Overlap

- The final order sought in the Panel proceedings is substantially the same as one of the orders sought in the Prospectus Proceedings in the Supreme Court, namely an order preventing shares being issued under the underwriting, without the approval of non-associated shareholders in a general meeting of PMA.

- There is also a substantial overlap in the facts and issues which would need to be considered. The terms and circumstances of the loans and other debts and of their proposed repayment are common to both proceedings. They comprise one of the two classes of omissions alleged in the prospectus (in the Prospectus Proceedings), and one of the main grounds for alleging that the directors benefited from the underwritten rights issue in ways which other shareholders could not (in the Panel proceedings).

- A related issue in the Prospectus Proceedings is whether the money proposed to be repaid should be put to alternate uses until it must be repaid. This indirectly raises issues concerning the company's access to alternative sources of funds, including non-underwritten issues and professional underwriting, which would clearly be issues in the Panel proceedings.

- Both proceedings will also consider whether the loans and their repayment were on arms'-length terms, the Prospectus Proceedings as part of assessing whether they contravene the related party transaction provisions and the Panel proceedings as part of ascertaining whether the directors derived benefits from the underwritten rights issue which were not available to other shareholders.

Nature and Interaction of Proceedings

- The Panel is designed to be a quick and commercial forum, for the practical and efficient resolution of certain disputes arising under Chapter 6 of the Corporations Act. For the parties to run and defend closely similar cases in the Panel and in the Supreme Court will be neither practical nor efficient. It is more likely to run up additional expense and take additional time.

- It is more appropriate that the proceedings in the Court continue than that these proceedings in the Panel continue. The remedies sought in the Panel proceedings are a subset of those sought in the Court. The Court proceedings can also deal with those issues directly, whereas in our proceedings they can only be dealt with tangentially.

- There is a risk that material lodged in the Panel proceedings will be provided to the Court, if these proceedings continue in parallel. This would be an undesirable interaction between the Panel proceedings and the Prospectus Proceedings, because much of that material could not have been obtained under discovery, as it will be made up of fresh submissions composed to be given to the Panel, not pre-existing documents.

Not prejudicial to Westgold

- It is true that, unlike the Panel, the Court cannot deal with the issue whether the acquisitions of shares under the prospectus or the underwriting were affected by unacceptable circumstances. This will not adversely affect Westgold, however.

- If the Court finds that that the issue should be stopped because the prospectus is defective in the ways suggested, or because it would contravene the related party provisions, there will be no point in continuing or resuming these Panel proceedings, because the only remedies sought in the Panel (other than the declaration itself) will already have been given by the Court.

- Westgold will also lose the benefit that Panel proceedings are typically faster than proceedings in a court. Westgold will not be adversely affected by the Panel proceedings being discontinued, however, as the substantial acquisition which concerns Westgold has yet to occur, and the matter is no longer urgent, because PMA has undertaken to the Court not to issue shares under the prospectus or the underwriting.

Decision to Dismiss

- Accordingly, we dismiss the application. We consent to Westgold and PMA being represented by their respective solicitors. There having been no declaration of unacceptable circumstances, there will be no order for costs. Unless an application for review of this decision is received on 25 March 2002, i.e. within two business days of the decision being announced on 21 March 2002, we will allow PMA to withdraw its undertaking not to issue shares.

Elizabeth Alexander AM

President of the Sitting Panel

Decision dated 21 March 2002

Reasons published 5 April 2002

TABLE

This is the table provided by Precious Metals Australia Ltd on 11 March

OUTCOME OF 6 FEBRUARY 2002 ISSUE

|

Issued Cap before Issue |

15,854,855 |

|

Total Entitlements accepted |

5,730,619 |

|

Issued Cap Post entitlement |

21,585,474 |

|

Shortfall |

10,124,236 |

|

Underwriters takeup |

8,173,536 |

|

New Issued Capital |

29,759,010 |

|

FUNDS RAISED FROM ENTITLEMENTS |

$573,062 |

|

Funds Raised from Underwriters |

$817,354 |

|

Total Funds raised |

$1,390,415 |

1 Westgold Resources NL v Precious Metals Australia Ltd and others matter no. CIV 2705 of 2000 in the Supreme Court of Western Australia. There are also unfair dismissal proceedings between Mr Smith, a director of PMA, and Saracen Mineral Holdings Limited, a listed company connected with Westgold, which were commenced in 2000 and appear to be still in progress.

2 Shares in PMA traded at prices from 10 cents to 22 cents in the six months before the prospectus was issued. The more recent prices were towards the lower end of the range, but volumes have been low and prices have been volatile.

3 The issue is not fully underwritten.

4 See also paragraph 1.32 of the Panel's draft policy on Unacceptable Circumstances.

5 This paragraph is based partly on the original application and partly on submissions in response to the brief.

6 The application for a declaration had to be inferred from a heading and from an application for final orders, which presuppose a declaration.

7 ASIC regulation 20.

8 And the decision of the High Court in Johns v ASC (1991)

9 Affidavit of Andrew David Chapman dated 8 March 2002, in Westgold Resources NL v Precious Metals Australia Ltd and others matter no. COR 69 of 2002 in the Supreme Court of Western Australia.